How to Get Cheap Car Insurance Without A Black Box?

Younger drivers and those that wish to reduce insurance premiums may opt to have a ‘black box’ installed in their vehicle. This handy piece of technology is installed in your car, usually for a period of 12 months, and uses telematics to monitor and track driving habits. For careful drivers, this type of policy can help to get the best price from one of the cheap car insurance companies the UK.

It is frequently used by new or drivers in the under 25 age group to get cheaper insurance. As the data collected is based on the history of the driver, it can be more accurate than insurance based on a group of people that may not reflect the safe driving habits of an individual.

While a black box can be beneficial for some, it may not work quite as effectively for others. For example, if you drive a large number of miles or take the occasional risk, a black box may not benefit you. In fact, it may have the opposite effect if it is determined that your driving habits are less than safe.

If you don’t use a black box and want to reduce the cost of your insurance premium, there are some other ways for you to lower your payments and obtain insurance coverage that is more affordable.

Consider using some of these tactics to lower your premiums.

Make annual payments

Paying your insurance premium on a recurring monthly basis often costs quite a bit more than making one annual lump sum payment. However, insurers tend to add fees for spreading your payments across 12 months, so paying a one-time renewal can bring some savings.

Shop around

Comparing quotes from multiple providers will often reveal much cheaper premiums for similar coverage. Use a quote comparison site and search for car insurance quotes using your information. Premiums and other insurance information can be reviewed to find the deal that is the most affordable.

Adjust your excess

Excess payments can make a difference to your insurance premiums. Higher excess payments can lower the cost of premiums. Adjusting the level of your excess will reduce the monthly payment, but just be sure that you have enough funds to pay the higher excess in the event of an accident.

Use your no-claims bonus

While this may sound like a no-brainer, it is surprising how many people forget to take advantage of their no claims bonus. This is especially true when changing insurance providers. Make sure you can verify your years of no claims and include the information with your new quote. As it is proof of your safe driving record, it can reduce insurance premiums substantially.

Reduce your risk profile

All insurance is based on risk; the higher the risk, the higher the cost. So if you are changing vehicles, it might be worth passing up the super-charged sports car for a safer vehicle. Depending on the insurance group your vehicle falls in, the cost of insurance can fluctuate dramatically.

Is black box car insurance worth it?

If you are still considering using a black box, there are some obvious advantages to proving your ability to operate a vehicle safely. However, while it can help save money on premiums, some other costs and fees are associated with a black box that needs to be considered.

These can include:

- Installation Fees

- Removal Fees

- Repair or Damage Fees

- Transfer Fees

There are also some limits imposed when using a black box, and these could be things such as restricted mileage or even a curfew that restricts very early morning or late night driving as these are the times that accidents are most likely to happen.

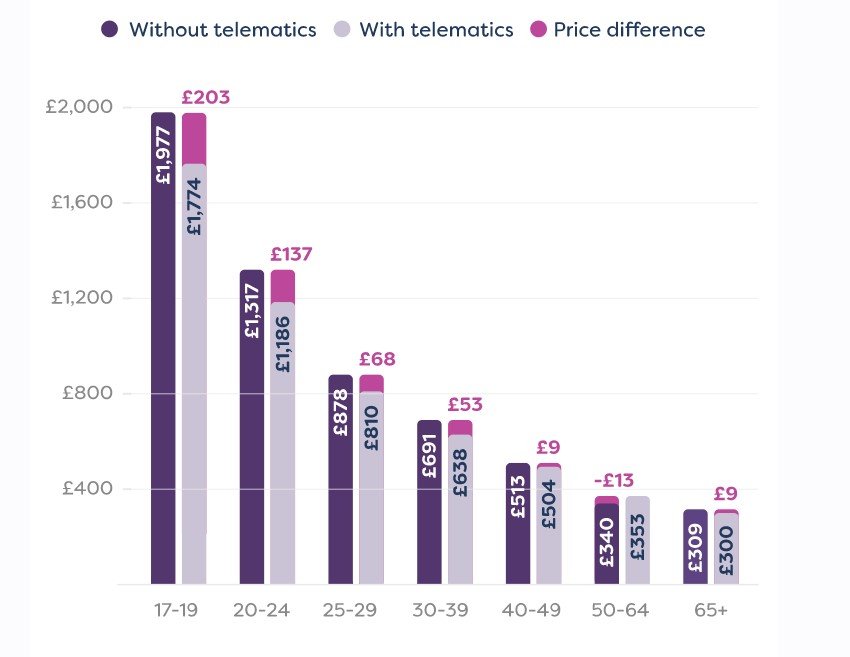

If you are prepared to abide by the restrictions, having a black box in your vehicle may enable you to get cheaper car insurance. For example, for very young and inexperienced drivers, the cost of insurance coverage is around £200 less when using a black box.

Image source: https://www.moneysupermarket.com/car-insurance/how-does-black-box-insurance-work/

The cost savings from a black box decrease with age and driving experience; however, if you have had numerous accidents or issues with driving convictions resulting in a poor safety record, using a black box may be a good way to re-establish a safe driving profile.

How do I know what is being recorded?

If you have any concerns about the tracking information being collected, most insurers operate with transparency so you can access your data. Typically you can access your details online from your insurance account or via an app to view your tracking history.

This visibility provides you with a chance to assess your own driving data and identify areas of improvement. In addition, tailoring your driving habits to be as safe as possible will help you to keep insurance costs as low as possible.